If you’ve ever looked at your student loan balance and wondered whether the degree was worth it, you’re definitely not alone.

According to the Pew Research Center, 35% of college graduates ages 25 to 39 who still owe student loans say their education wasn’t worth the lifetime financial cost. That’s more than one in three young professionals questioning whether the return on all that studying, testing, and late-night ramen was really worth the bill that came after.

Feeling that way doesn’t make you bad with money. It makes you human. The good news is that your story with debt doesn’t have to stay stuck on the same page. You can turn it into a plan that actually works for your life.

Step 1: Stop Seeing Debt as a Life Sentence

Debt feels heavy because it represents past decisions that seem permanent. But it isn’t permanent.

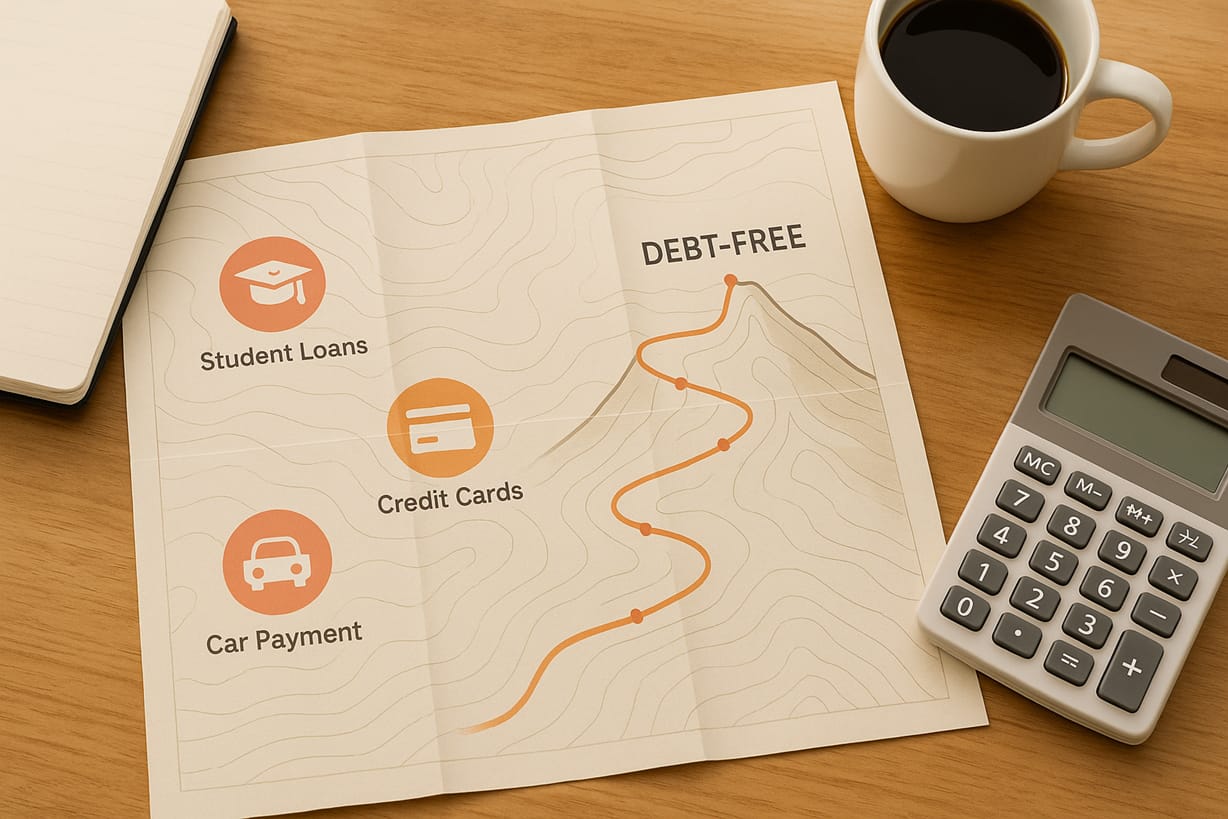

Start by writing down every debt you have — student loans, credit cards, car payments, whatever’s on your plate. Next to each one, list the balance, the interest rate, and the minimum payment.

It might feel uncomfortable, but this step is about taking your power back. Once you see everything clearly, you can decide what happens next instead of letting your debt decide for you.

Step 2: Pick a Pay-off Strategy That Fits You

There’s no one-size-fits-all plan. The “right” payoff strategy is the one that matches how your brain works.

If you like small wins, try the snowball method — pay off your smallest debt first, then roll that payment into the next one.

If you want to save money on interest, try the avalanche method — focus on the highest-rate debt first, even if it’s the biggest.

Can’t choose? Use a hybrid — start with one quick win for motivation, then shift to high-interest targets.

If student loans are part of your mix, check whether an income-driven plan or refinancing could make payments more manageable. Sometimes relief starts with a little paperwork.

Step 3: Automate and Simplify

Once you’ve chosen your plan, make it automatic.

Set up autopay for minimum payments so you never miss a due date. Then schedule a small, consistent “extra” payment on the debt you’re targeting — even $25 a week adds up to $1,300 a year.

Simplify your money flow too. One account for bills, one for spending, one for saving. Fewer decisions mean fewer chances to fall off track.

Step 4: Track Wins, Not Just Balances

Paying off debt can feel like running uphill for months before you see the view. So celebrate the small stuff — paying off a single loan, reaching a new thousand-dollar milestone, or simply keeping your credit utilization under 30%.

Progress builds confidence.

Make it visual if you can. A simple spreadsheet, app, or even a paper tracker turns invisible progress into something you can actually see.

Step 5: Build a Small Safety Net

If you don’t have a cushion, one unexpected expense can throw your whole plan off.

Start with $500 to $1,000 in a basic savings account. Once that feels steady, grow it to one month of living expenses.

You don’t need to pick between saving and debt payoff. You can do both, slowly and steadily, by automating each one.

Why This Matters

Debt isn’t just about numbers. It’s about freedom — the freedom to change jobs, move cities, or finally take a vacation without guilt.

At RedSky Money, we help people tackle real-world money questions with clear, practical advice that fits their lives. If debt feels like a mountain, you don’t have to climb it alone.

Try This This Week

Pick one debt — any debt — and plan to pay just $25 extra toward it. Then tell someone you trust what you’re doing. Sharing your goal makes it stick.

Small moves like this can start the momentum that changes everything.

If you’d like a personalized money plan, RedSky Money offers free consultations to help you start strong and keep moving forward on your financial journey.